Who We Are

Ehsan Shariah Advisors and Consultants (ESAAC) is a company that deals in providing niche Shariah management and financial advisory services. Our strength is designing, structuring, and implementing Shariah-compliant structures to meet intricate business and financial needs.

By merging the academic brilliance of our Shariah professionals with the financial savvy of our consultancy experts, ESAAC facilitates institutions in harmoniously integrating Shariah compliance within their core business. Our services cover Full-Fledged Islamic Banks, Islamic Microfinance Institutions, Islamic Banking Windows, Takaful and Re-Takaful Operators, Islamic Mutual Funds, Islamic Asset Management Companies, and High-Net-Worth Individuals (HNIs).

With a keen emphasis on sustainable and responsible growth, we deliver clients with customized solutions that not only are compliant with regulation and Shariah but also generate long-term value. ESAAC is a respected partner for firms that aim to enhance operations, enhance competitiveness, and stay truly Shariah-compliant.

Our Services

Where Shariah Principles Meet Strategy,

Innovation & Technology

Empowering Businesses Through Shariah-Compliant Strategies & Innovation

Leadership Rooted in Integrity and Innovation

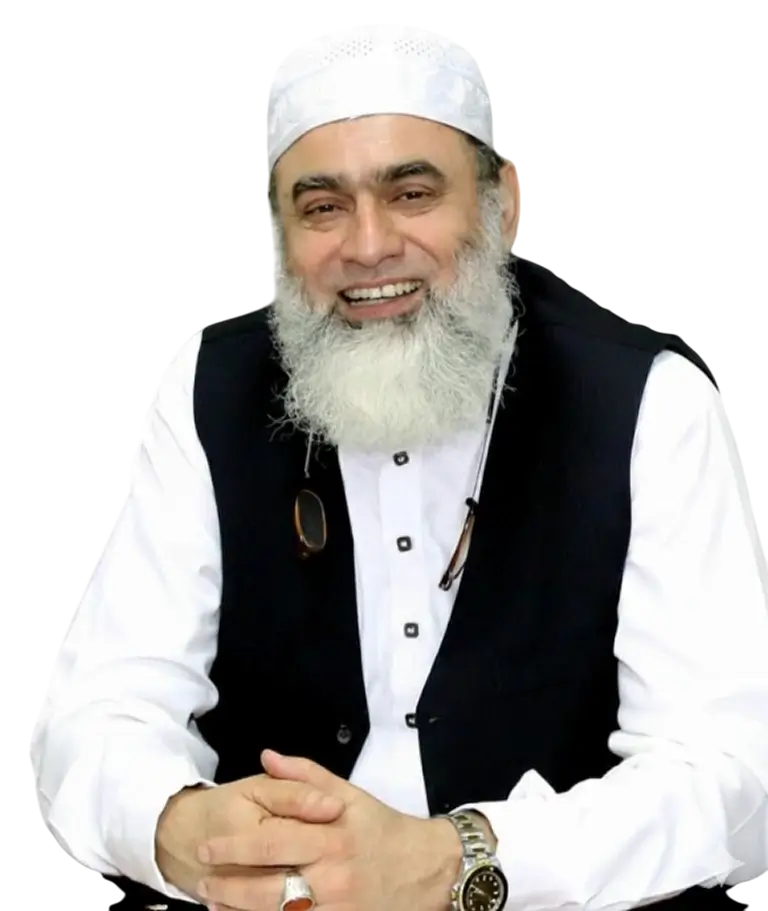

Mufti Ehsan Waquar

Alhamdulillah, Mufti Ehsan is among the few scholars who possess a unique combination of religious and contemporary education. He has strong communication skills combined with fluency in several languages. Graduating as a Shariah Scholar and a Mufti, he later accomplished Masters in Economics and Masters in Business Administration with majors in Finance. On top of this, he accomplished Bachelors in Law and Legislation. This unique blend of educational combination gives him an edge upon many others to understand, correlate and align modern day banking practices with Shariah principles.

Ehsan has a diversified cross-functional management experience in Islamic Finance, Business Management and Operation, Project Management and Administration for more than two decades; he has hands-on experience of people and projects management, with a rich experience of working with board of directors and senior management of banks, regulators, auditors and legal counsels.